State of the States 2024

A comprehensive review of the commercial gaming sector in 2023, providing financial performance figures and market analysis for the 36 jurisdictions with commercial gaming operations.

State of the States 2024

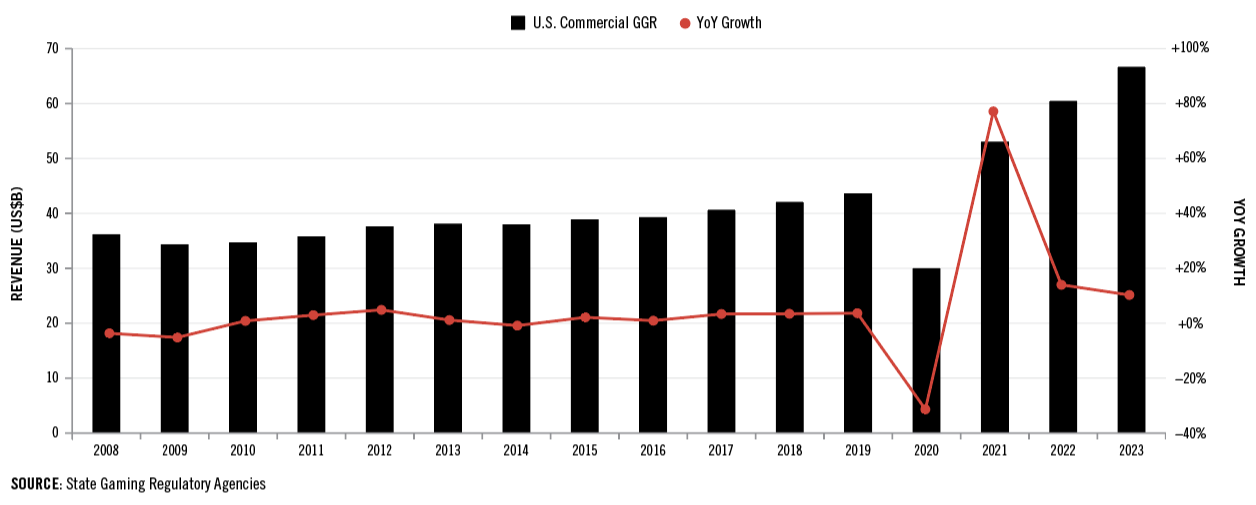

The U.S. commercial gaming industry generated record-breaking revenue for a third consecutive year in 2023 amid strong growth in traditional casino games offered a land-based casino resorts as well as through iGaming and mobile sports betting platforms.

Annual U.S. Commercial Gaming Revenue

Commercial gaming revenue reached a record $66.66 billion in 2023, 10.3% higher than 2022

30 of 36 states set annual records for commercial gaming revenue

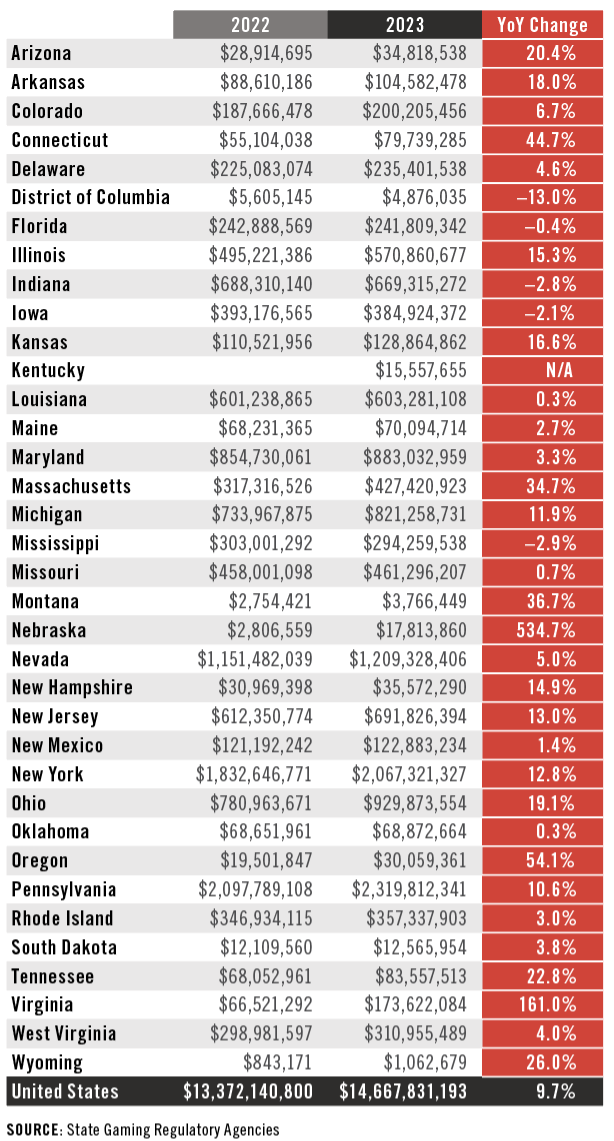

Commercial gaming operations generated $14.67 billion in direct gaming tax revenue paid to state and local governments, not including billions more paid in income, sales or other taxes

“As gaming expands, more communities than ever are benefiting. We are proud to create jobs across the country, provide world-class entertainment experiences that offer safe alternatives to the pervasive illegal gambling market, and generate tax revenue to support critical public projects.." - AGA President And CEO Bill Miller

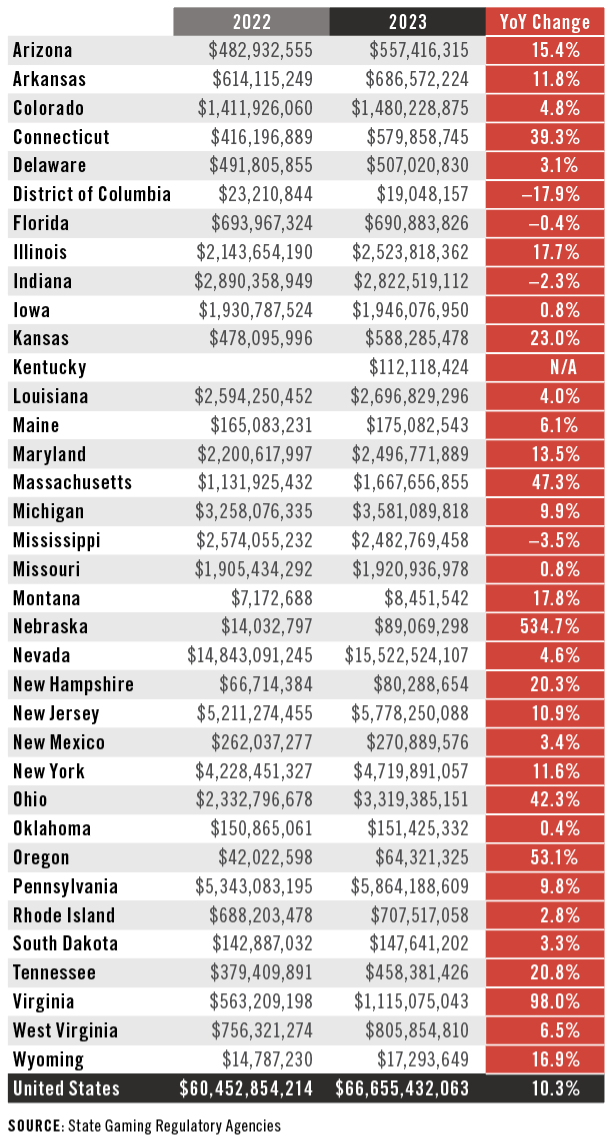

In 2023, 32 of the 36 jurisdictions with commercial casinos, iGaming or sports betting operations saw a rise in annual gaming revenue, with only the District of Columbia, Florida, Indiana and Mississippi contracting. Thirty of the 36 jurisdictions posted record levels of commercial gaming revenue. Notably, Kentucky joined the commercial casino marketplace in 2023 with the launch of sports betting in the Bluegrass State.

Commercial Casino Gaming Consumer Spend by State 2022 vs. 2023

The surge in gaming revenue resulted in a record $14.67 billion of direct gaming tax revenue paid to state and local governments by commercial gaming establishments, a 9.7 percent increase compared to 2022. This figure just includes specific state and local taxes directly linked to gaming activities and does not include the billions of dollars more paid by the industry in the form of income taxes, sales taxes or various corporate taxes, nor does it incorporate the payroll taxes paid by gaming operators and suppliers. Federal excise tax payments made by sports betting operators are also excluded from the total.

Commercial Casino Direct Gaming Tax Revenue by State 2022 vs 2023

The gaming industry defied broader macroeconomic concerns related to stubborn inflation and high interest rates in 2023 as consumers displayed strong demand for both traditional casino games offered at the 486 commercial casinos across the country, as well as newer iGaming and sports betting offerings. Across the 27 states with land-based commercial casinos, revenue from traditional casino games was a record $49.38 billion in 2023, up 3.3 percent versus the prior year.

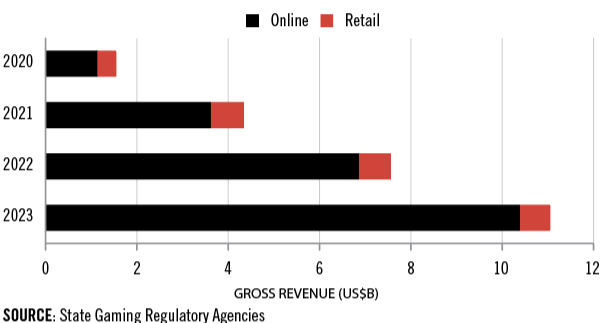

The legal sports betting market launched in five new states in 2023: Ohio, Massachusetts, Nebraska, Kentucky and Maine. That expansion helped drive sports betting revenue up 46.0 percent year-over-year, from $7.56 billion in 2022 to $11.04 billion in 2022, as Americans bet a total of $121.06 billion on sports throughout the year.

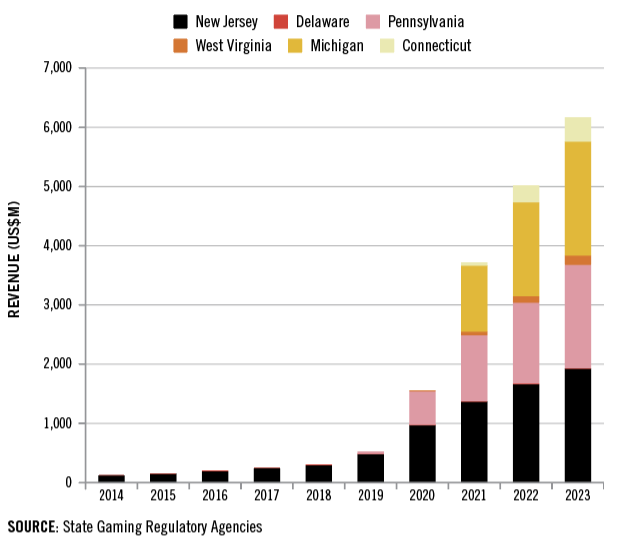

Despite no geographic expansion, the iGaming market also continued its explosive growth in 2023, with combined iGaming revenue from six active states (excluding Nevada’s online poker only market) reaching $6.17 billion, a 28.2 percent increase year-over-year.

Regulated Sports Betting Revenue – 2020 to 2023

United States: Regulated iGaming Revenue – 2014 to 2023

About State of the States

AGA’s annual State of the States report details the commercial gaming industry’s financial performance, including analyses of each of the 36 jurisdictions with commercial gaming operations in 2023. The report, developed with VIXIO Regulatory Intelligence, also provides a breakdown of the legality of types of gaming and number of casinos by state, summarizes major gaming policy discussions, and previews opportunities and challenges for the industry. The companion State of Play map provides the report findings, as well as key regulatory and statutory requirements for each state, in an easy-to-use, interactive tool.